The Powerful Quasimodo Pattern

The Quasimodo pattern is one of the most reliable reversal patterns in technical analysis, offering traders exceptional risk-reward ratios and early trend identification. If you’ve been searching for a chart pattern that consistently delivers results, the Quasimodo pattern might be exactly what you need. This comprehensive guide will teach you how to identify the Quasimodo pattern, understand its structure, and execute profitable trades using this powerful formation in both uptrends and downtrends.

What Is the Quasimodo Pattern in Trading?

The Quasimodo pattern is a technical chart formation that signals potential trend reversals before they become obvious to most traders. Named after the famous hunchback character from Victor Hugo’s novel, this pattern features a distinctive asymmetrical structure that sets it apart from other reversal patterns.

Many traders also know the Quasimodo pattern as the “Over and Under” pattern because of its relationship to the classic Head and Shoulders formation—though with a notably crooked appearance. What makes the Quasimodo pattern so valuable is its ability to identify exhaustion points in existing trends, giving you an early-warning advantage that can significantly improve your trading results.

If you’re looking to enhance your forex trading strategies, mastering the Quasimodo pattern should be at the top of your list.

How the Quasimodo Pattern Forms in Different Market Conditions

Bearish Quasimodo Pattern in Uptrends

When you’re analyzing an uptrend, you’ll typically see a consistent pattern of higher highs and higher lows—this reflects buyer dominance and positive market sentiment. However, the bearish Quasimodo pattern begins to form when price suddenly creates a low that falls below the previous low, breaking the established uptrend structure.

This unexpected drop is your first clue that bullish momentum is fading. The bulls are losing control, and sellers might be preparing to take over. Once you spot this structural break in your price action analysis, you’ll want to prepare for a potential short opportunity when price retraces back to key resistance levels.

Bullish Quasimodo Pattern in Downtrends

The bullish Quasimodo pattern works in reverse. In a downtrend characterized by lower highs and lower lows, watch for price to suddenly push higher and create a high that exceeds the previous peak. This disruption of the bearish sequence signals that sellers may be losing control.

When this structural change occurs, buyers are starting to step in and challenge the downtrend. The pullback to previous support areas then becomes your opportunity to enter long positions, positioning yourself early in what could become a significant upward move.

Understanding these reversal patterns is crucial for any serious trader looking to improve their market timing.

ical Points of the Quasimodo Pattern

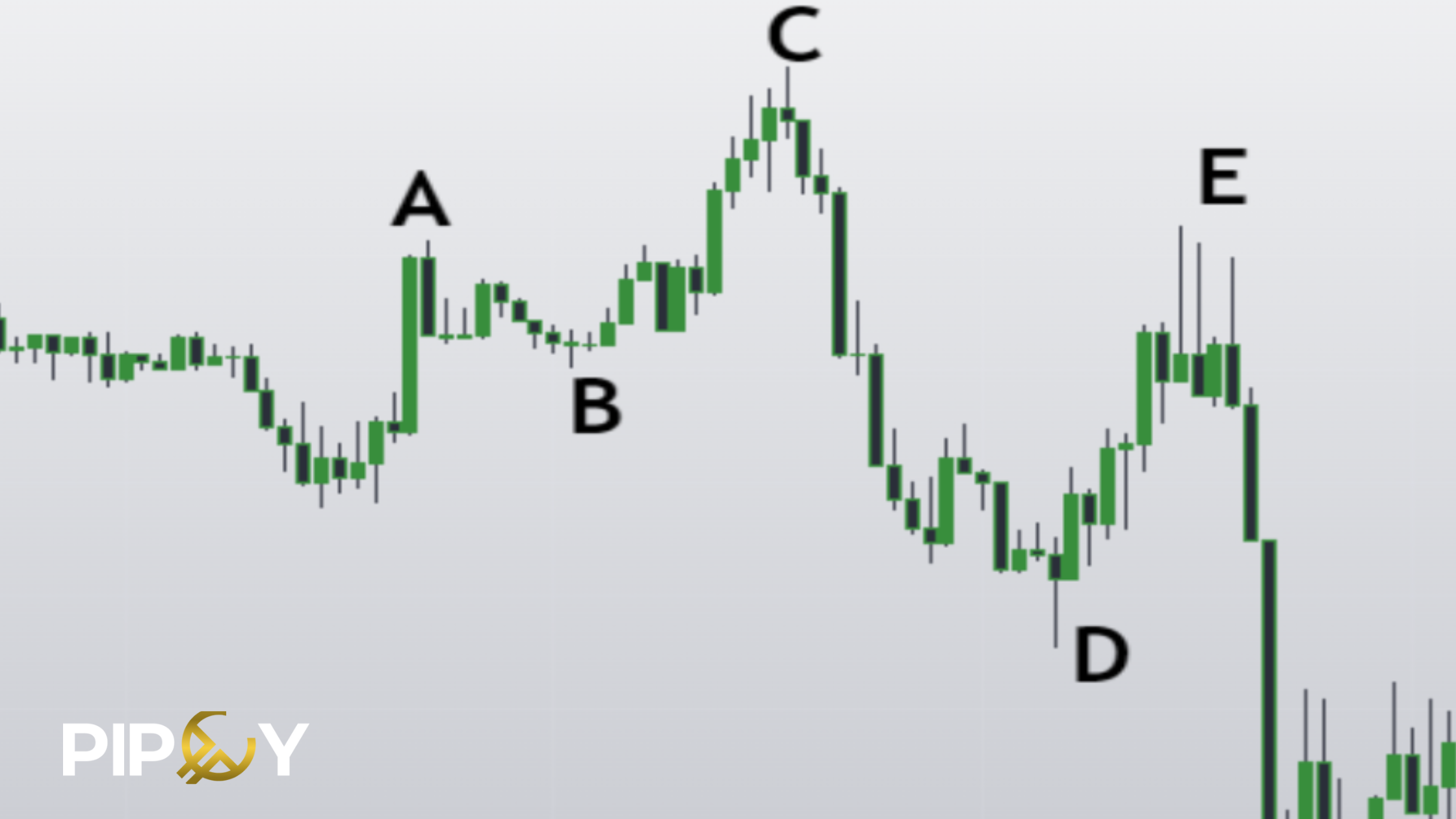

Understanding the Bearish Quasimodo Pattern Setup

To effectively trade the bearish Quasimodo pattern, you must identify five specific reference points on your chart. Think of these as your roadmap to profitable trades:

- Point A: The second-to-last peak in the uptrend, also known as the “left shoulder.” This level becomes important for your eventual entry point.

- Point B: The final trough of the uptrend, which remains higher than previous lows, maintaining the bullish structure—for now.

- Point C: The highest peak achieved during the uptrend, representing maximum buyer enthusiasm before the reversal.

- Point D: The critical breakdown where price drops below Point B, violating the uptrend structure. The faster and more aggressive this move, the more reliable your Quasimodo pattern becomes.

- Point E: Your entry zone where price retraces from Point D back toward Point C (the Quasimodo level). You’ll typically initiate short positions around the Point A level.

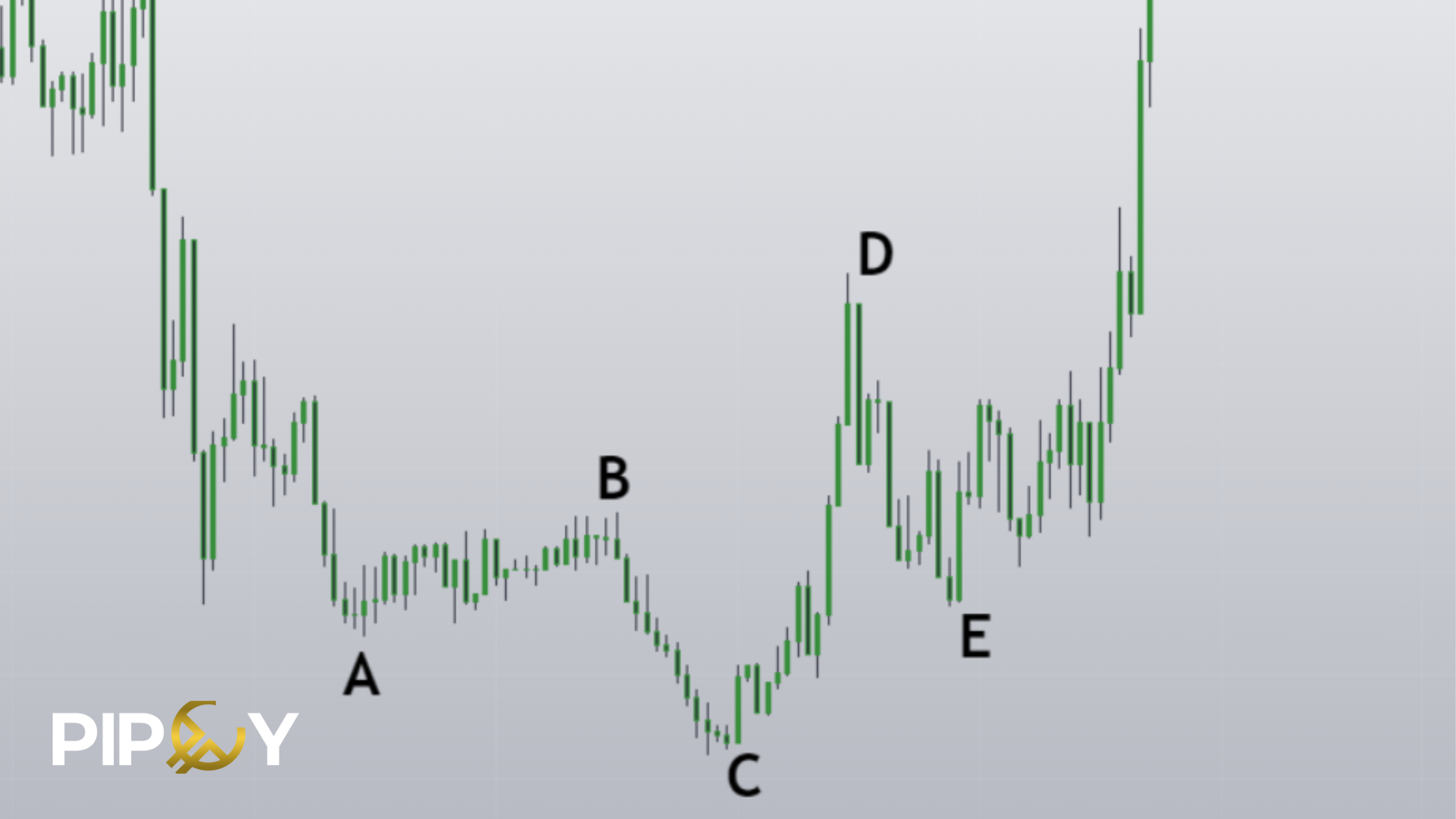

Understanding the Bullish Quasimodo Pattern Setup

The bullish Quasimodo pattern follows an inverse structure with equivalent reference points:

- Point A: The second-to-last trough in the downtrend, establishing your left shoulder baseline.

- Point B: The final peak before the breakout, maintaining the downtrend’s lower high pattern.

- Point C: The lowest point reached during the downtrend, marking maximum selling pressure.

- Point D: The pivotal breakout where price surges above Point B, breaking the downtrend structure. Strong, rapid moves enhance pattern reliability.

- Point E: Your entry zone as price pulls back from Point D toward Point C. Long positions are initiated near the Point A level.

Learning to spot these key points quickly is essential for successful forex trading. Practice identifying the Quasimodo pattern on historical charts until recognition becomes second nature.

Why Traders Love the Quasimodo Pattern

The Quasimodo pattern has earned its reputation as a favorite among professional traders for several compelling reasons:

- Exceptional Risk-Reward Ratio: The pattern’s structure naturally creates scenarios where potential profits substantially exceed potential losses. Even with a 50% win rate, you can achieve consistent profitability.

- Early Trend Entry: Unlike many chart patterns, the Quasimodo pattern gets you positioned near the beginning of new trends rather than after significant moves have already occurred.

- Clear Risk Management: Stop loss placement is straightforward—just above the last high for bearish setups or below the last low for bullish configurations.

- Proven Reliability: The Quasimodo pattern has demonstrated consistent effectiveness across multiple markets, timeframes, and trading conditions.

These advantages make the Quasimodo pattern an essential tool in your trading strategy arsenal.

How to Trade the Quasimodo Pattern: Step-by-Step Guide

Trading the Bullish Quasimodo Pattern

When you’ve identified a bullish Quasimodo pattern, follow these execution steps:

- Entry: Place a buy limit order slightly above Point C. For precision, drop to lower timeframes to identify demand zones near the Point A level.

- Stop Loss: Position your protective stop just below Point C. If price reaches this level, the pattern has failed and you exit immediately.

- Take Profit: Target previous resistance levels, Fibonacci extension levels, or Point D as a conservative profit target.

Trading the Bearish Quasimodo Pattern

For bearish Quasimodo pattern trades, your setup looks like this:

- Entry: Place a sell limit order slightly below Point C. Use lower timeframe analysis to spot supply zones near Point A for better precision.

- Stop Loss: Set your stop just above Point C—simple and effective risk management.

- Take Profit: Aim for previous support levels, Fibonacci projections, or Point D as your initial target.

Remember to adjust your position sizing according to your overall risk management strategy. The Quasimodo pattern offers tight stops, which allows for larger position sizes while maintaining proper risk control.

Advanced Quasimodo Pattern Confirmation Techniques

While identifying the Quasimodo pattern provides your foundation, sophisticated traders incorporate additional confirmation before committing capital. Simply recognizing the formation isn’t enough for optimal results—you need multiple factors aligning in your favor.

Multi-Timeframe Confluence

Check whether your Quasimodo pattern level coincides with significant support or resistance on higher timeframes. This confluence dramatically increases the probability of a strong price reaction. When the Quasimodo pattern appears at major weekly or daily levels, its reliability improves substantially.

Price Compression Analysis

When price reaches Point E, observe how it’s behaving. Is it compressing and consolidating? This compression often precedes explosive moves in your anticipated direction. Tight consolidation at the Quasimodo level suggests building pressure that’s about to release.

Supply and Demand Zones

Drop down to smaller timeframes and look for supply and demand zones at your entry level. This granular analysis helps you refine your entries for even better precision. The Quasimodo pattern becomes even more powerful when combined with supply and demand trading principles.

This multi-layered approach transforms basic pattern recognition into comprehensive market analysis, significantly enhancing your trade quality and overall performance. For more on combining technical indicators, check out this guide on technical analysis.

Common Quasimodo Pattern Trading Mistakes to Avoid

Even experienced traders can make errors when trading the Quasimodo pattern. Here are the most common pitfalls:

- Ignoring the Strength of the C-D Move: Remember, the faster and more decisive the move from Point C to Point D, the more reliable the pattern. Weak, hesitant moves suggest the pattern may fail.

- Entering Too Early: Wait for price to actually reach the Point E zone. Don’t anticipate—let the Quasimodo pattern complete its formation.

- Placing Stops Too Tight: While the pattern offers good stop placement, give your trade some breathing room. A stop placed exactly at Point C might get stopped out by normal market noise.

- Neglecting Context: The Quasimodo pattern works best when aligned with the bigger picture. Don’t trade it against major trend directions or during low-liquidity periods.

Avoiding these mistakes will dramatically improve your success rate with the Quasimodo pattern.

Quasimodo Pattern vs. Other Reversal Patterns

How does the Quasimodo pattern compare to other popular reversal patterns?

- Quasimodo vs. Head and Shoulders: While similar in structure, the Quasimodo pattern offers earlier entry opportunities and typically tighter stops due to its asymmetrical nature.

- Quasimodo vs. Double Top/Bottom: The Quasimodo pattern provides more precise entry points through its five-point structure, whereas double tops and bottoms offer less specificity.

- Quasimodo vs. Triple Top/Bottom: The Quasimodo pattern forms faster and requires fewer confirmations, allowing you to catch reversals earlier in their development.

Each pattern has its place in your technical analysis toolkit, but the Quasimodo pattern stands out for its combination of early signals and reliable execution.

Best Timeframes for Trading the Quasimodo Pattern

The Quasimodo pattern works across all timeframes, but certain periods offer distinct advantages:

- 4-Hour Charts: Ideal for swing traders, offering a balance between signal frequency and reliability. The Quasimodo pattern on 4H charts provides high-quality setups several times per week.

- Daily Charts: Perfect for position traders seeking the most reliable signals with the highest probability outcomes. Daily Quasimodo patterns carry significant weight.

- 1-Hour Charts: Suitable for active day traders who can monitor markets regularly. More setups but require more active management.

- 15-Minute Charts: Only for experienced scalpers. The Quasimodo pattern appears frequently but with increased false signals.

Start practicing on higher timeframes where the Quasimodo pattern is most reliable, then work your way down as you gain experience.

Final Thoughts on Mastering the Quasimodo Pattern

The Quasimodo pattern represents one of the most valuable tools in any technical trader’s arsenal. Its combination of favorable risk-reward characteristics, early trend identification capabilities, and proven reliability makes it worthy of serious study and incorporation into your trading framework.

Whether you’re analyzing uptrends or downtrends, the Quasimodo pattern provides actionable signals that enable adaptive strategy implementation. Take the time to master the identification of those five critical reference points and understand what they reveal about market structure. Practice on historical charts until pattern recognition becomes instinctive.

When you combine the Quasimodo pattern with proper risk management, multi-timeframe analysis, and the confirmation techniques we’ve discussed, you’ll have a reliable strategy that works across any market you trade. Start small, track your results, and gradually build confidence in this powerful reversal pattern.

Ready to take your trading to the next level? Check out our Free Trading Academy or explore more forex trading strategies to complement your Quasimodo pattern trading.

Get Funded here