Range Trading Forex: Master Sideways Market Strategies for Consistent Profits

When currency pairs move laterally rather than trending upward or downward, traders face a distinct set of challenges and opportunities. Range trading forex markets commonly referred to as consolidation zones demand specialized approaches that differ from trend-following methods. This comprehensive guide explores effective techniques for capitalizing on range-bound forex markets and turning sideways price action into profitable opportunities.

Understanding Lateral Price Movement in Forex Range Trading

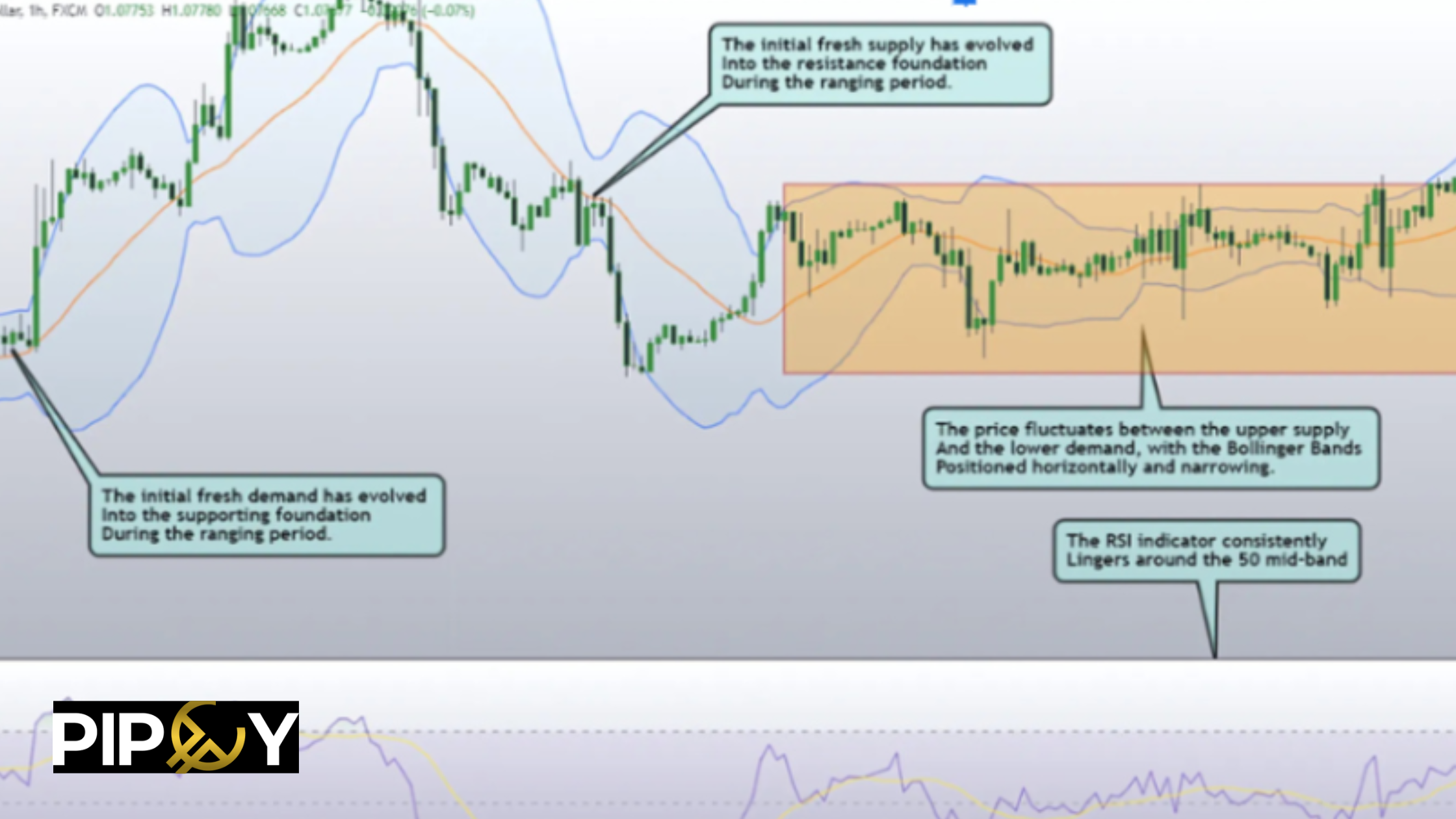

A range-bound market emerges when currency prices oscillate within defined upper and lower boundaries without establishing a clear directional trend. This behavior indicates equilibrium between buying and selling pressure, often representing a pause before the market chooses its next direction. Mastering range trading forex techniques allows you to profit during these consolidation periods.

Key Features of Consolidation Zones:

Boundary Formation:

- Upper limits form where selling interest outweighs buying demand

- Lower limits develop where purchasing activity exceeds selling pressure

- These boundaries strengthen through repeated price interaction

Market Psychology:

- Reflects temporary balance between bulls and bears

- Often precedes significant directional moves in forex trading strategies

- Creates predictable bounce patterns within established limits

Trading Implications:

- Directional strategies may underperform

- Mean-reversion approaches become more effective for range trading forex markets

- Breakout opportunities eventually emerge

Three Proven Approaches for Range Trading Forex Markets

Strategy 1: Boundary-to-Boundary Trading

This method capitalizes on predictable price oscillations between range extremes and is fundamental to successful range trading forex execution.

Implementation:

- Initiate long positions when prices approach lower boundaries

- Close longs or enter shorts near upper boundaries

- Confirm entries using candlestick reversal patterns

- Place protective stops slightly outside the established range

Optimal Tools:

- Bollinger Bands help identify extreme conditions in range trading forex setups

- Price action patterns provide entry confirmation

- Tight risk management prevents false breakout losses

Explore our guide on advanced trading strategies to enhance your range trading forex skills.

Strategy 2: Breakout Capture

Eventually, most ranges resolve with a decisive move beyond their boundaries. Understanding breakout dynamics is crucial for range trading forex success.

Execution Method:

- Monitor for strong moves through established limits

- Confirm breakouts with momentum indicators

- Wait for retests before entering positions

- Use volume analysis to validate genuine breaks

Critical Success Factors:

- Patience to avoid premature entries in range trading forex setups

- RSI confirmation of momentum strength

- Volume surge verification

- Retest confirmation reduces false signals

For more on breakout strategies, check out our guide on price action.

Strategy 3: Trend Alignment Within Ranges

This hybrid approach combines mean reversion with trend analysis for enhanced range trading forex performance.

How to Apply:

- Identify the dominant trend on higher timeframes

- Trade only in the trend direction when price reaches range boundaries

- Use moving averages to confirm overall market bias

- Benefit from both trend reliability and range predictability

Essential Technical Tools for Range Trading Forex

Bollinger Bands

These volatility-based bands excel at identifying range trading forex conditions. Horizontal bands signal consolidation, with the lower band suggesting potential buy zones and the upper band indicating possible sell zones.

RSI (Relative Strength Index)

This momentum oscillator helps spot reversal opportunities in range trading forex markets. Divergences between RSI readings and price movement often foreshadow range boundary bounces.

Moving Average Analysis

Flat moving averages confirm the absence of directional momentum. These indicators smooth price data while revealing the underlying market structure critical for range trading forex success.

Pro Tip: Combining multiple indicators with raw price action creates more reliable trade signals when executing range trading forex strategies.

Protecting Your Capital in Range Trading Forex

Successful range trading forex requires robust risk controls to handle market uncertainty.

Position Sizing Guidelines

- Reduce position sizes compared to trending markets

- Limit individual trade risk to 1-2% of total capital

- Account for increased volatility within ranges

- Maintain consistent risk parameters across all range trading forex positions

Dynamic Stop Management

- Implement trailing stops that adjust with favorable price movement

- Preserve profits while accommodating normal fluctuations

- Adjust stop levels based on volatility conditions

- Balance protection with reasonable breathing room

Maintaining Discipline

- Execute only high-probability range trading forex setups

- Resist impulse trading outside your plan

- Prioritize trade quality over quantity

- Avoid revenge trading after losses

Profit Target Framework

- Base targets on actual range dimensions

- Maintain minimum 1:2 risk-reward ratios in range trading forex trades

- Set realistic expectations for range-bound conditions

- Adjust targets based on market volatility

Advanced Range Trading Forex Techniques

For traders looking to take their range trading forex skills to the next level, consider these advanced concepts:

- Volume profile analysis to identify high-probability reversal zones

- Market structure recognition for anticipating range breakouts

- Correlation analysis between currency pairs in consolidation

- Order flow reading for institutional activity at range boundaries

Common Mistakes to Avoid in Range Trading Forex

When implementing range trading forex strategies, be aware of these frequent pitfalls:

Premature Breakout Trading:

- Entering trades immediately after a boundary break without confirmation

- Solution: Wait for retests and volume confirmation

Ignoring Market Context:

- Trading ranges during high-impact news events

- Solution: Check the economic calendar before executing trades

Poor Risk Management:

- Using position sizes too large for range trading forex volatility

- Solution: Always risk no more than 1-2% per trade

Overtrading:

- Taking every touch of support and resistance

- Solution: Focus on the highest probability range trading forex setups only

Read our guide on avoiding common forex trading mistakes for more insights.

Final Thoughts on Range Trading Forex

Range trading forex markets present distinctive profit potential for traders who understand their mechanics. Success requires recognizing consolidation patterns, applying appropriate technical analysis, and maintaining rigorous risk discipline. Rather than viewing sideways markets as obstacles, skilled traders see them as opportunities to profit from predictable price behavior.

The foundation of profitable range trading forex lies in patience and methodical execution. Resist the urge to force trades or deviate from proven strategies during quieter market periods. Instead, maintain focus and continuously refine your skills to adapt as market conditions evolve.

Ready to elevate your range trading forex performance with professional support? At Pipcy, we provide comprehensive trading education, market analysis, and tools designed to help you succeed across all market conditions. Explore our trading resources and educational content to take your forex trading to the next level.